Life’s three peaks that will decide our housing future

A series of demographic mountains will shape demand for residential property over the coming decade. But the big shifts in population also suggest more fundamental challenges to the Australian taxation base, to the health system, to the labour market as well as to demand for mental health and even spiritual guidance services.

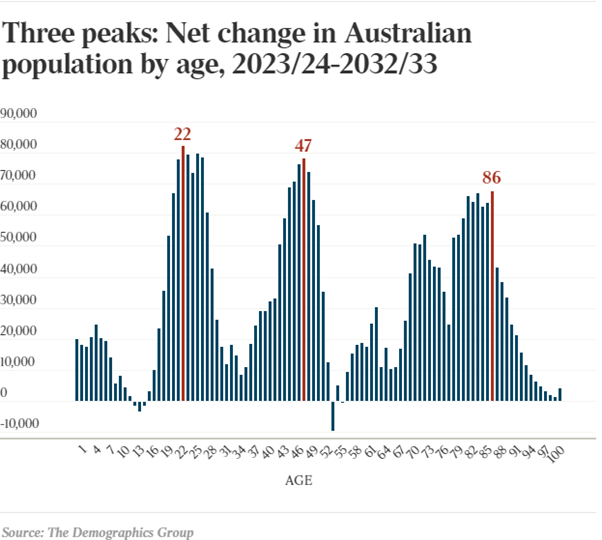

The data behind this chart is sourced from the Centre for Population (CFP) which was established as an advisory group within the federal department of the Treasury just prior to the pandemic. The CFP published estimates of the Australian population by single year of age for all states (and capital cities) into the 2030s in January. I have taken this group’s published projections and calculated net change over the decade to 2034 or 10 years hence.

This is the first “official” medium-term demographic outlook for the Australian nation in the post pandemic era. The Australian Bureau of Statistics releases official population projections once every five years about a year after the release of census data.

However, the business community cannot wait for a preset five-year review of Australia’s demographic outlook to get an understanding of the impact of the pandemic. That is why the January projections by the CFP were necessary: they help the recovery process.

Technically the January projections do not reflect the recently-announced 400,000 net overseas migration estimate for the current financial year and so the base data isn’t perfect, but it’s the best available at the current time. And the trends this dataset reveals are so compelling that a year or two of hyped migration (in the 20s cohort) doesn’t really change the overall insights this analysis offers.

The key insight this chart shows is that the post-pandemic decade will be shaped by three peaks, namely:

● Net growth in the 20-26 cohort peaking at age 22

● Net growth in the 42-50 cohort peaking at age 47

● Net growth in the 78-86 cohort peaking at age 86.

These peaks are undeniable. They exist in the demographic bedrock upon which our nation is based. The peaks might moderate and shuffle older or younger with policy shifts later in the decade but not substantially. The evidence of the three-peaks chart shows that the balance of the 2020s, and the early years of the 2030s, will be shaped by a surge in the population aged, or fizzing around the ages of:

● 22: student Gen-Zers or Zoomers born 2002-2020

● 47: Middle-aged Millennials born 1983-2001

● 86: Increasingly frail Boomers born 1946-1964.

Gen-Xers (born 1965-1982) are in this chart too but their numbers were structurally weakened by the advent of the contraceptive pill in the late 1960s and by diminished immigration in the 1970s.

Interestingly the “valley” between the Millennial (47) and the Zoomer (22) mountains reaches a low point at age 33 in the decade to June 2034. This reflects a much diminished birthrate in the year 2001 – which prompted the then federal treasurer to suggest to patriotic parents to have three kids: one for dad, one for mum and “one for the country”. And judging by the uptick in the population aged less than 33 in the decade to June 2034, it is evident that Australian parents responded enthusiastically to the treasurer’s suggestion. (The Zoomer peak was boosted by progressively greater student intakes later in the decade.) The three-peaks chart suggests hyped demand for student and other 20-something-friendly rental properties later in the decade.

Indeed this outlook chart supports the build-to-rent proposition in Australian cities. Interestingly the Zoomer (22) and the Millennial (47) mountains are higher in the Sydney and Melbourne markets than in other cities because our biggest cities attract overseas students and 20-somethings from regional Australia.

It’s all part of the “bright-lights effect” where young Australians, and others, gravitate to metro markets in search of job opportunities, education, training and for social interaction. The three-peaks chart also shows rising demand for what might be described as trophy homes or “forever homes” by a rising pool of middle aged Millennials.

Quite separately, the 2021 Census shows that the peak full-time income earning stage in the life cycle applies across the early- to mid-40s. The peak-earning year (for full-time workers) is 43. What lies ahead for the Australian economy, and tax base, is an alignment of the demographic planets.

A “mountain” of Millennials will pass through the 43-47 stage in the life cycle between, say, 2023 and 2033 generating peak income (and tax) and requiring peak home. And all of this kicks off in the years immediately following the pandemic when the building industry’s labour pool is diminished. More Australians pushing into the preparing-for-teenagers time in the life cycle (peaks at 47) hypes demand for what previous generations called McMansions, but which Millennials might change to something like “lifestyle homes with fully kitted out Zoom rooms”.

This kind of property could be delivered on the urban edge, in the lifestyle zones beyond the capital cities, or indeed in middle suburbia via a program of “making over” older-styled suburban homes. The point is that 20-something Millennials created hipster culture; their middle-aged incarnation later this decade will increasingly pivot around the home, lifestyle and family. And this generation will have the spending power to pursue their housing and lifestyle preferences. The surge in the frail Boomer (aged 78-86) population over the coming decade will prompt demand for more independent retirement living facilities, for more assisted care, for more homes being refitted to accommodate older residents, and for a surge in the loneliness that stems from losing a life partner late in life.

New data captured by the 2021 Census shows that anxiety and depression cited as long-term health afflictions skyrocket in the Australian community from the age of the late 70s onwards.

Indeed, according to CFP projections there is likely to be 150,000 Australians aged 86 in 2034 up from 82,000 today. One of the challenges for the property industry is to find ways of injecting “community connection” into housing options for these frail elderly.

The three-peaks chart shows vastly more 20-something and 40-something workers over the coming decade. But there are glitches in this outlook from a labour market perspective. The Australian labour pool will remain shallow in the late-20s, in the early-30s and across the Gen-Xer afflicted 50s and 60s cohorts. These glitches suggest reduced depth in the labour pool for selecting middle management and suggesting an even greater requirement for automation and AI.

An ageing community might trigger intergenerational tensions as the frail elderly require ever greater health care services and funding. Census data shows that religious affiliation is greatest among those aged 80-and-over. The third peak, the frail Boomer mountain, suggests that there might be a shift towards traditional belief systems. And if this is correct, then Australia might need to import not just chefs and data scientists but also more spiritual advisers (religious ministers) by the early 2030s.

The three-peaks chart – enabled by the Centre For Population based on the best available data at the time of publication – suggests three core themes for the decade ahead.

● The further “studentification” of the inner city and support for the build-to-rent market.

● The rise of the lifestyle home suited to middle aged Millennials preparing for the arrival of teenagers.

● The emergence of the frail elderly Boomer market requiring ever greater care and greater connection into the community.

But there are wider questions this chart raises, including the fact that despite Australia’s strong population growth the labour market will remain notoriously lumpy. More 40-somethings and 20-somethings doesn’t deepen the labour pool for businesses that require skilled workers in their early 30s. However, Australia’s demographic outlook still delivers growth, even if it is lumpy, which I argue builds the case for optimism for Australia in the decade ahead.

Source: The Australian, Written by Bernard Salt