Expensive Properties Drive Market Rebound

The performance of the housing market can vary dramatically from region to region, but also across the different product types and value ranges. Splitting the market into quartiles can provide a better understanding of which sectors are firing and which ones are lagging.

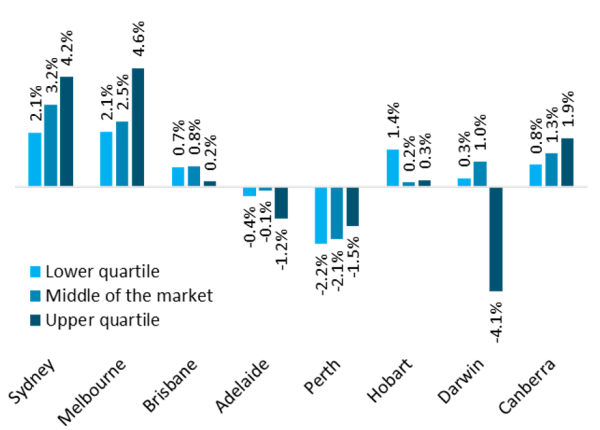

In Sydney and Melbourne its clearly the prestige end of the market that is driving the strongest capital gains, with values up 4.2% and 4.6% over the September quarter across the top quartile of the market. This was also the sector that recorded the largest decline during the down phase, with Sydney’s top quartile properties remaining 13.6% below their previous peak while Melbourne’s top quartile properties are still 11.9% below their peak.

Brisbane is showing stronger growth conditions across the middle to lower valued properties where values are 0.8% and 0.7% higher over the quarter. During the downturn the middle to lower priced segments of the market were also more resilient to falls than the top end.

Similarly, Adelaide is showing better resilience to falling values across the more affordable end of the market while the top quartile records the largest declines over both the quarter (down 1.2%) and cumulatively (down 3.5% since peaking).

The opposite is true in Perth were the high end of the market has been a little more resilient to falling values. While each of the broad valuation cohorts has recorded a sustained drop in values, the reduction has been less severe across Perth’s top quartile where values are down 16.5% since peaking compared with a 27.8% decline across the lower quartile.

Hobart has been one of the strongest markets over the past few years, however with affordability constraints becoming more pressing, the lower quartile properties are showing a better performance relative to more expensive properties. The lower quartile saw a 1.4% rise in housing values over the September quarter after posting a smaller loss relative to the top quartile.

Darwin’s housing market has been doing it tough since 2014, however the September quarter has seen the lower and middle quartiles actually record a subtle increase in housing values while the upper quartile continues to record heavy loss. All three of the broad valuation cohorts have recorded material declines in values since peaking, demonstrating the broad based declines across Darwin's housing market.

Canberra’s upper quartile housing is the only broad housing segment across the capital cities where values were at a record high at the end of the September quarter. Values are rising across all three of the broad market segments, however it’s the top quartile where growth is strongest.

The different performances of the housing market across broad valuation groups highlights how diverse conditions can be below the surface. Factors such as housing affordability, lending policies, market cycles and local economic and demographic conditions can have a significant baring on market activity.

Source: CoreLogic (Tim Lawless)